|

Is the seemingly big hurdle of opening your investment accounts stopping you from starting?

Fear no more, my friend! This task is surprisingly easy!

1 Comment

Do you think you are ready to start investing?

Congrats! Investing is a great way to build wealth for your future, and is a key component to reaching financial freedom. But before you get started, make sure you understand these three important things! Being in the final year of my 20's is a weird mix of depressing... and exciting.

Now that thirty is officially right around the corner, and certainly seems older than 29, I'm looking forward to leaving the turbulent 20's behind! While this was a fun decade, your 20's can be a difficult time. Struggling to pay for school, working weird hours, failed relationships, small paychecks, inconsistent paychecks, bad financial decisions, and not feeling like you have fully hit your stride yet are all too common.

When you are first learning about investment accounts, one of the big questions is... traditional IRA or Roth IRA? Both of these accounts are GREAT places to be saving for your future, but the tax perks are very different!

One of the highlights for the traditional IRA is that contributions are tax deductible. If you're saving in a Roth IRA on the other hand, your contributions are NOT tax deductible. Watch the video below to learn why this could be a GOOD thing!

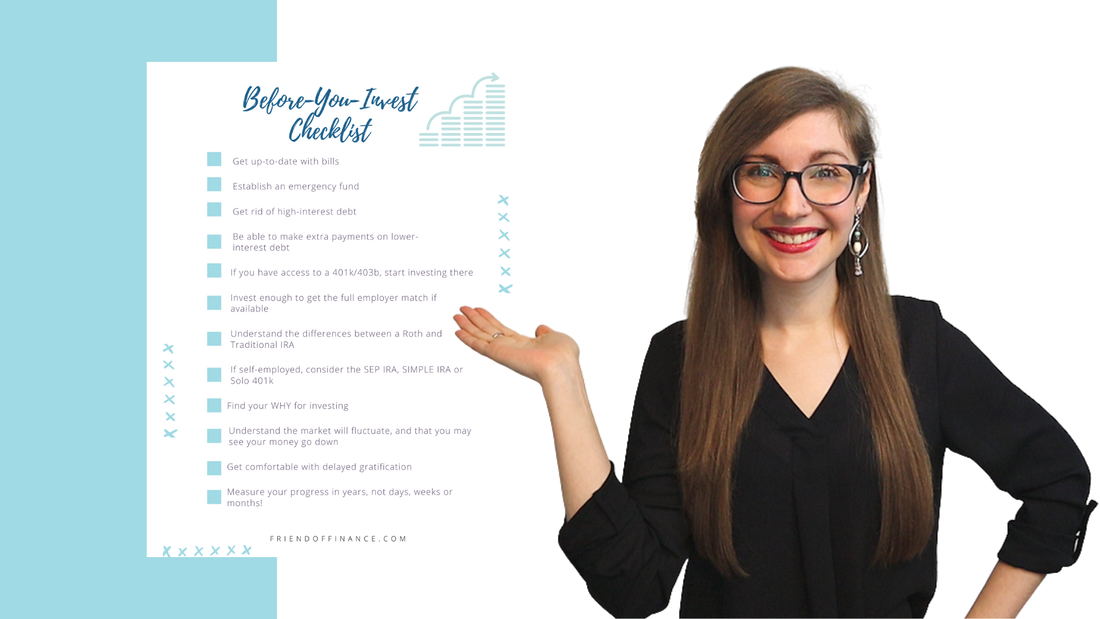

Are you getting ready to start investing? If so, congratulations! This is my favorite part of personal finance, and growing wealth for your future can be so empowering!

But to make sure your journey with investing starts on the right foot, make sure you're ready. Both financially, and mentally! Grab a free copy of my checklist below! Are the stimulus checks and Bitcoin boom a weird coincidence?

Stimulus checks + our country collapsing = ...a lot of people talking about Bitcoin?!

There is a LOT going on right now (but don't let that kill your New Year, New You vibe). In the mix of crazy, I've been seeing a lot of not great advice out there. Specifically about Bitcoin. So let's talk about this extra $600, and if any of it should be going into a new crypto account... How can investing help lower your taxes?

Yes, investing is a great way to grow wealth, but there are also a lot of tax-saving benefits too!

Investments made in certain accounts allow you to deduct contributions when you file your taxes. This means you are lowering your taxable income, and making the pile of money you owe taxes on smaller. Smaller pile? Less taxes. (Legally). Watch my video below where I share the three accounts you can invest in to lower your taxes! How using rewards points for this move saved us hundreds of dollars

As if 2020 wasn’t exciting enough, I just finished up a big old road trip across the country! Phase 2 of moving to Washington state has been completed, (phase 3 includes a tiny house and 22 acres of land that need some lovin’, I’ll let you know more about that later) and a saving grace in this move has been TRAVEL REWARDS POINTS!

I can only take a little responsibility for the magic that happened along the way (shout out to my bf and all those Hilton points) but I wanted to share this journey with you so you can put travel rewards on your radar- even if you aren’t doing much traveling right now. And lucky for you, there is even a love story intertwined in this financial and travel-hacking guide… Ready to break up with your big bank? See what you should be avoiding in your business checking account

If I'm being honest, this is a little embarrassing to admit, but I finally ended things with Chase. (Chase...bank, that is).

I'm not one to talk $hit after breakups, but I know I'm not the only one out there that put up with all the red flags of my bank for way too long. This wealthy-feeling milestone might not stretch as far as you think...

A millionaire. $1,000,000. What is it about this number that makes it so significant? The 6 zeros? The TWO commas? Or is it simply the first financial milestone that actually has a title? (Hundred-thousandaire just didn't catch on or what?).

|

Archives

April 2021

Categories |

RSS Feed

RSS Feed