How much can your contribute to your retirement accounts for 2020?

Well, now that my 2019 taxes are finally filed, it’s time to start thinking about 2020! Yes we are already halfway through the year, and no, we probably won’t get a tax extension next year, but you still have until April 15th, 2021 to contribute to your IRA’s for 2020.

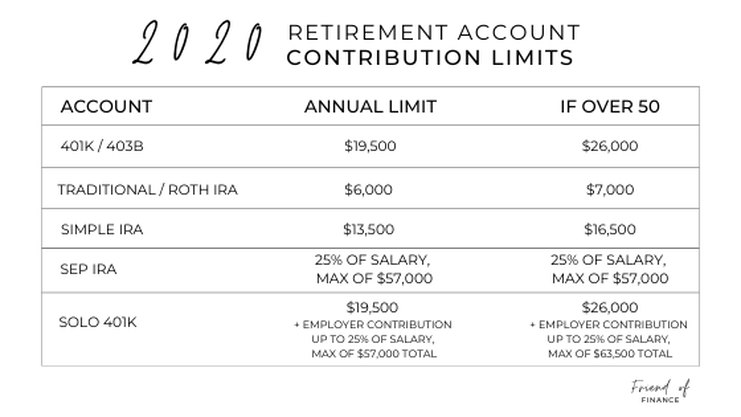

This year brought us an increased limit for employer plans; 401k’s and 403b’s limits are up to $19,500 (from $19,000 in 2019), SEP IRA’s up to $57,000 ($56,000 in 2019) and SIMPLE IRA’s at $13,500 ($13,000 in 2019), where Traditional and Roth IRA’s remained the same after increasing to $6,000 in 2019.

Staying on top of your contribution limits is important for a few reasons. Take my dad for example, he is a couple years away from 60, and has been packing as much as he possibly can into his retirement accounts, hoping to retire ASAP. People in that position can really benefit from an increase in contributions, especially with the additional $6,500 in “catch-up” contributions on employer plans that are available to those over 50… that is, if they are aware of them.

Those who are using retirement contributions to lower their taxable income (which, let’s be real, we all should be doing, regardless of your tax bracket) also need to be aware of increases to contributions. The more you put away into tax-deferred accounts, the less money you are taxed on today! Increases in contribution limits is also exciting news for FIRE enthusiasts. FIRE stands for Financial Independence, Retire Early, and the idea behind this movement is to save and invest as much as possible, as quickly as possible, and hop off the rat wheel and retire as soon as it’s financially feasible. If you’re someone who is projecting your retirement and counting down the years, increases in limits will get you to your goal that much quicker. Are you allowed to max out multiple accounts?

Yes, but not all of them simultaneously, and not willy-nilly. The retirement account system can seem a little complex at first, but once you understand how they work, that tax rules make a little more sense.

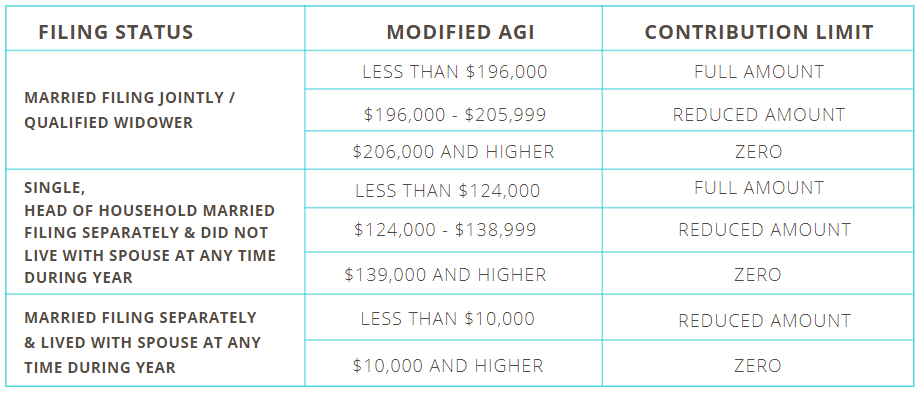

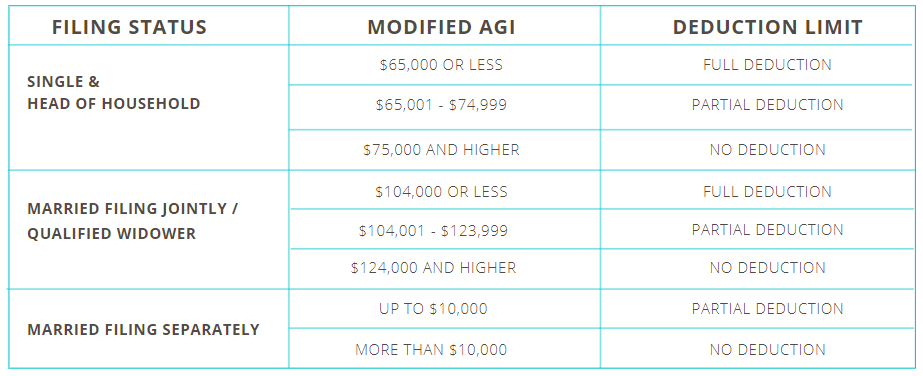

Traditional and Roth IRA’s are both individual accounts, because they are opened and funded by the individual (you, me, your dad etc.). Even though these accounts are taxed differently from each other, the are in the same group as far as contribution limits are concerned. Your $6,000 ($7,000 if over 50) limit can be spread between these accounts, but you cannot max them both at $6,000 individually. You can put $3,000 in each, or any other variation which equals $6,000 (or $7,000 if over 50) but no more. 401k’s, 403b’s, Solo 401k’s and SEP IRA’s all have an employer aspect, because they are opened by both an employer or a self-employed person, and have the potential to be funded by an employer and employee. Between both employee and employer contributions, the maximum is $57,000 (Plus the catch up if over 50 within the 401k’s/403’s). This means you are allowed to contribute to both a 401k and a SEP IRA, as long as your combined contributions to both accounts do not exceed $57,000 for 2020. Can you contribute to a 401k and Traditional or IRA? Yes, and you can max out both of them, but you have to be aware of the income phase-out (check the chart below) for actually deducting your contributions, or the phase-out for being eligible for Roth contributions. What about a SEP and Traditional/Roth? Yes, you can still max out both, but again, be aware of the income phase-out and limitations. Income Phase-Out for Roth IRA's 2020IRA Contribution Deduction Limits 2020

Click here for a ~FREE~ Financial Desk Sheet with all the important dates and tables you and your business needs!

What about a Solo 401k and a SEP IRA? This is one combination that is kind-of a no-no. The IRS prefers you do not have both of these accounts opened at once, so if you are moving from one to the other, it would be wise to do a rollover of your old account into your new one. What happens if you over-fund your retirement account?

The moment you overfund your account, alarm bells start ringing in the IRS, your face and account balance pop up on camera… no, not really. But honestly, I’ve thought how easy it would be to overfund sometimes (don’t worry, I haven’t). When I moved to a new account last year, the amount I had already made in contributions was not carried over, so my $6,000 max contribution to my Roth essentially started over. Since you do not report Roth contributions (like you would with traditional or SEP IRA contributions) when you file your taxes, overfunding could potentially go unnoticed. Keeping track of your contributions is your responsibility, and nothing visibly bad will happen if you do overfund...not right away at least. The penalty if you are caught is a 6% excise tax on the amount you overfunded, every year it’s there. The longer you “get away” with over funding, whether you are aware of your mistake or not, the more costly the ticking tax bomb gets.

It would be best practice to avoid any penalties, especially those from the IRS. Keeping up to date on your contribution limits, and keeping record of your contributions is worth the time! To help stay on top of your finances, make sure to grab a free copy of my Financial Desk Sheet! Save it to your desktop, or print and laminate so you never have to Google-search these contribution limits again!

0 Comments

Leave a Reply. |

Archives

April 2021

Categories |

RSS Feed

RSS Feed