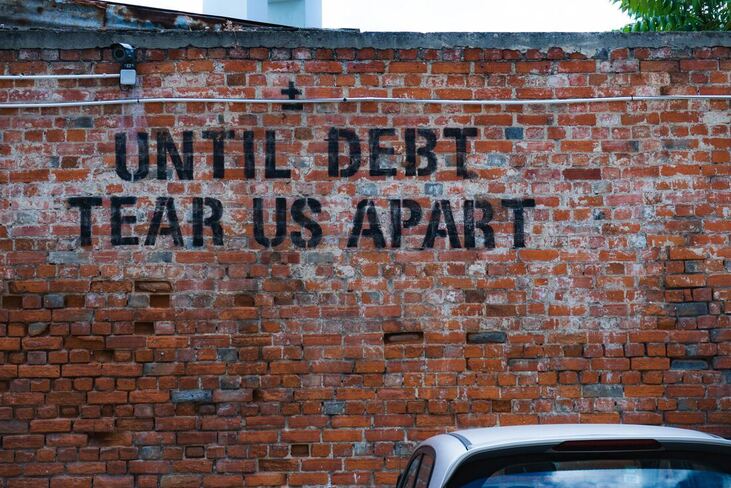

Student loan debt is something a growing number are struggling with. This is my personal experience with managing student loan debt so far.It's a quiet morning, I know the stock market has been slipping the last few days so I pull up the 'Stocks' app that's incorporated into Apple products nowadays, confirm that yes, everything does seem to be down by a percent or two. I click through a few articles, one on the student loan epidemic, another on how president Trump apparently hasn't been playing by the rules while filing his tax returns... It all makes me sad and angry. When we grow up and become contributing adults to society, the first few years can be intimidating. Taxes are a complicated subject, student loans are arguably even more complicated, along with everything else we must do. Mortgages, probably, but I can't speak from experience on that yet because I'm still renting. There's a lot of red tape, rules to follow, and processes that must be completed in a certain order. Let's look at student loans and the loan forgiveness program. Student loans have been a part of my life since the age of seven, and not because I was a super genius that started college at a young age, but because that's when my mom decided to go back to school, and I became aware of being poor. Looking back, I don't even know how my mom managed. She was a single mom of two young daughters after going through a divorce five years earlier, and the decision of going back to school to become a teacher resulted in her renting out her little yellow house and moving into the upstairs of my grandparents large, victorian home. She cleaned houses for a living while going through school, and took out student loans.

Seven-year-old me had no idea how these student loans actually worked, I just knew that at the start of the school year, our little family had money. It was the one time where we could go shopping, and my sister and I could get whatever we wanted. My mom finished her degree and we were able to move back into our yellow house when I was thirteen. I thought that now that my mom had a teaching job, we would have more money. Anyone who is a teacher or knows a teacher that's reading this- feel free to let out a small laugh, or cry. My mom started, and ended, her teaching career in one of the lowest income schools in the area. As I grew up, I saw my mom struggle with money endlessly. Her take-home pay kept shrinking. The amount taken out for insurance kept increasing. Every few years she would have to spend a few thousand dollars to go back to school, to keep up her certification to keep her low-paying teaching job. She deferred the payments on all of her student loans, she simply couldn't afford them. After putting over a decade into teaching, she left. Besides not physically being able to afford this awful system, the mental and physical drain of being a teacher was taking its toll. She works at a health food store now, and her take home is probably a little higher than it was as a teacher, but not by much. She is overqualified for her position, and still living paycheck to paycheck. Recently she decided to get her student loans in check, up until this year I think she had just been ignoring them. She is following the "Loan Forgiveness" guidelines, everything was consolidated and she has to make the minimum payments for 10 years, and then a portion of her $80k of debt will be forgiven. "Forgiven". Now I read that, as of March 31, 2019, of all Public Service Loan Forgiveness applications that were submitted, only 1% were approved. This boils down to the red tape in all of these industries, the red tape and fine print. The government set up this program to try and direct a qualified workforce into areas that needed them. People put in their time earning peanuts in hopes that the heavy weight of their student loans would one day be wiped away. 99% of the people that applied for the "forgiveness" they believed they would get, were denied. Silly you, you didn't read all of the fine print when you were a desperate 19-year-old trying to figure out how you could afford a 30k annual tuition on a waitress's salary! Our own desperation combined with the government's ability to run the student loan program has left a growing group of people that are being smothered by debt. Now, one exit strategy that many were counting on, doesn't seem to be working as everyone had hoped. When I first took out my own student loans, I had the experience of my mother to base my own process on. Just get a loan, the terms aren't really important, and worry about it later. In fact, when you're applying for federal student loans, you actually have quite little say in the terms you are offered. Getting the money you need now is what's important, and what comes after is a problem for another day. Thankfully, after graduating, I got personal with my loans. Instead of shoving them under the rug, as many do, I learned that my one private loan of $14,000 had a variable interest rate which started at 7%, and apparently could increase whenever those in LIBOR-land decided they wanted it to. The next couple of years were a race, could I pay this off before my interest was at 12%? I ended up paying that particular loan off at the end of last year, 13 months early with my final interest rate being 10.5%. While paying off a loan is an amazing feeling- it's not exactly a fun race to run. And that's why many people don't participate, and would rather walk the marathon that is paying off your debt. And some are so overwhelmed by the idea of running this race, they simply defer it. Meanwhile, the sum in deferment is acquiring interest at an astronomical rate. To run with this analogy (hah), I'll give you my own example. I graduated with my bachelors in 2014 with $19,500 taken out in loans. I only got out this low because I went to school in China, where I wasn't even eligible to take a loan, and was lucky enough to live with family and able to work my way through my first two years and pay my 10k annual tuition in cash. I finished my degree in England, where I could apply for student loans to fund my final year. After graduating, I pursued postgrad, and thanks to a scholarship only required another $13,000. I assumed this would help cover my living costs for the next year or two, but ended up dropping the postgrad after my first year. By 2015 I had a total of $32,500 in student loan debt, from three different loans growing at a variable 7% and a fixed 6% and 3.5%. Now, option A is to start running. Run the $32,500 marathon, and understand it will take longer than $32,500 because of the interest, so just imagine a race track that is slowly being lengthened before you. The faster you run, the less time they have to extend your track. Option B is to look at that track and mutter to yourself "f**k, I can't afford that, maybe in the future when I'm making more." This is deferment. Your track continues to get longer as compounding interest works against you, and you aren't even at the starting line. Most people are somewhere in-between, which we can call Option C. Option C is making the minimum required payments; you're running, the race absolutely sucks, the track is getting longer, and you know you're going to be running for the next 20-30 years. Let's be clear, NONE of these options are fun. They all involve an awful race where you are throwing more money than you ever imagined at a loan that you once needed, but now are like "why the eff did I sign up for this! Where's my lawyer?!" (Jk, you know you can't afford a lawyer). The marathon is even less fun if you end up in a career that doesn't pay well enough to justify your debt. Your track is extended at a faster rate, your running shoes have holes in them and you can't even afford new ones for the next 10 years, at least. Currently, close to 45 million Americans are in the student loan debt marathon. So if it's any solace to others who read this and are feeling the weight of their own loans, you're not alone. But now is when you can decide what kind of race you want to run. Sources: The Wall Street Journal. Program to Relieve Student Debt Proves Unforgiving. https://www.wsj.com/articles/program-to-relieve-student-debt-proves-unforgiving-11557221400?mod=searchresults&page=1&pos=10 NBC News. These five charts show how bad the student loan debt situation is. https://www.nbcnews.com/news/us-news/student-loan-statistics-2019-n997836

1 Comment

How do I deserve such beautiful, intelligent children?!! You are a part of changing this world and making it a better place. (I must have eaten pretty healthy during my pregnancy 😉). Never give up the fight for what’s right. Now, time to go to work so I can start paying off those student loans.

Reply

Leave a Reply. |

Archives

April 2021

Categories |

RSS Feed

RSS Feed