|

A lot can happen in 10 years, and as time goes on, it only seems to moves more quickly.

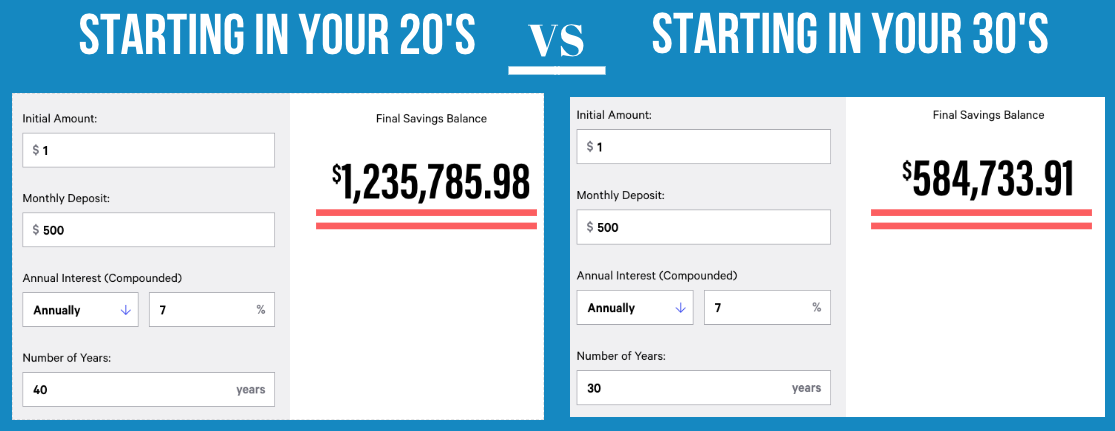

Many things have the gift of growing and flourishing over time. A nice wine, a planted seed, your retirement account. Just like a small seed that will eventually become a great tree, your retirement account has to start somewhere. The sooner you get that seed in the ground, the larger it will be by the time you retire. Most people in their 20’s are not in their peak earning years yet. Paychecks may feel like they are already stretched too thin, and because of this, many put off saving for retirement. You may not have been offered a 401k at work in your lifetime, and maybe you never even thought to start saving on your own. There are always reasons not to save, but the longer you accept these reasons, the less you are giving to your future self. In the two examples below, $500 a month is invested for 40 years and 30 years, earning an annual 7% interest. The ending balance after 40 years is DOUBLE what it is for 30 years. Double. Let that sink in.

If you plan on retiring in your 60’s, saving and investing $500 a month starting in your 20’s is all it takes to retire a millionaire. Even if you can’t save $500, saving something will put you miles ahead of saving nothing, and the sooner you make monthly investing a habit, the easier it will be. As your pay increases, you can increase your monthly contributions.

If you have a 401k at work, make sure you are contributing to it. If you get an employer match, try to contribute enough to get the full matching amount. If your employer doesn’t offer a 401k, you can open an IRA or Roth IRA on your own, and fund it yourself. You can contribute up to $6000 for the 2019 tax year, and you even have until Tax Day- April 15th, 2019 to make contributions. Saving for your retirement isn’t something you want to put off, because the longer compounding interest has to work its magic, the more money you earn. Being able to save for your future isn’t about the size of your paycheck, it’s about your behavior. A monthly retirement contribution should be treated like any other bill, except this is one you pay to yourself. If you have questions about any of the above, please do not hesitate to reach out! If you are interested in opening up your own IRA and figuring out an investment strategy, I would be more than happy to help. Calculator used: https://www.bankrate.com/calculators/savings/simple-savings-calculator.aspx

1 Comment

|

Archives

April 2021

Categories |

RSS Feed

RSS Feed