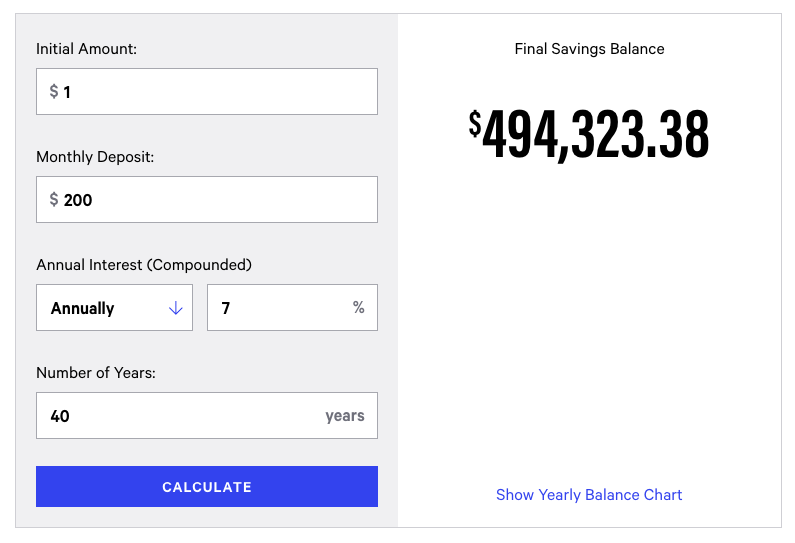

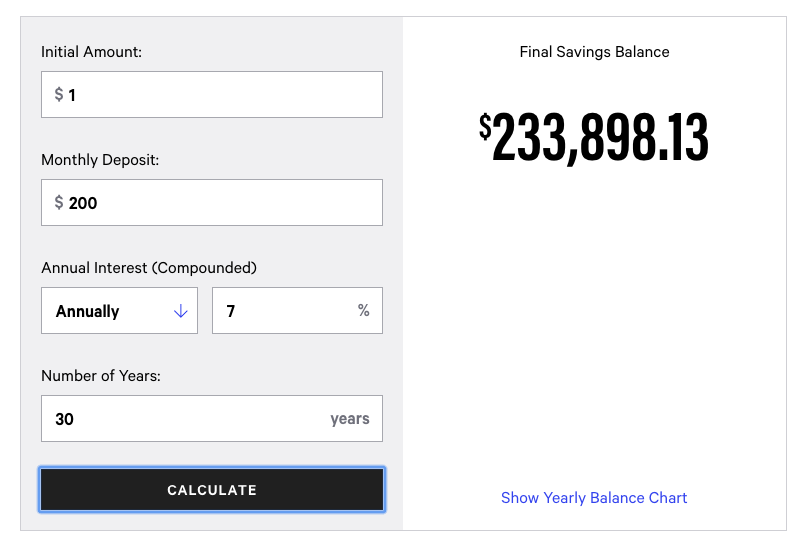

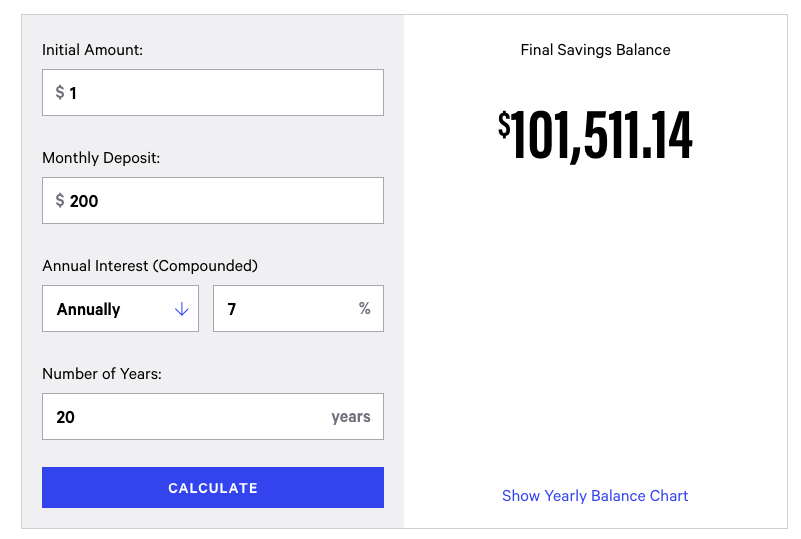

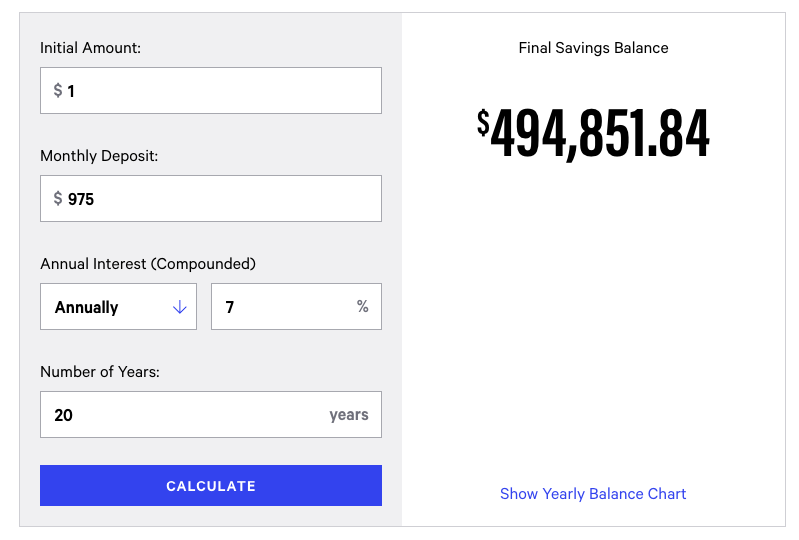

Saving for retirement is something you don't want to procrastinate, because the sooner you start, the greater the potential benefits of compounding interest in your account.As we get older, we understand there are things we should be doing, or should be getting better at, and are vaguely aware of strategies we should be implementing throughout our adulthood. Some of these things have a heavy financial focus, and if they are topics we don’t truly understand or deem them too difficult for the moment, they get pushed onto a to-do list for our future selves. One of the major tasks many 20 or 30-somethings decide to wait on is planning for retirement. I get it, something that is 40 years away is not at the forefront of your mind when you see this week's paycheck hit your account. You need to focus on this months bills, student loan payments, saving for a down payment on a house, saving for a wedding, paying childcare expenses, paying off your credit card… the list goes on. But the thing is, the sooner you begin, the easier it will be. There are countless articles, calculators and planning tools out there that will all show the huge difference that can be made when you start planning for retirement in your 20’s versus you 30’s or 40’s. Depending on where your age lies on this spectrum, the results can be truly empowering, or extremely frightening. In the next few examples pictured, we are going to assume the following: -An initial amount invested of $1 -An ongoing deposit of $200 monthly -Annual Interest of 7% Our changing variable is how long we have to save. Let’s say you’re 25 years old, and plan on retiring at age 65, giving you 40 years of saving and compounding interest. If you were to start with $1 and invest $200 a month for the next 40 years and receive on average 7% interest, you would end up with nearly half a million dollars. Of that $494,323, the amount you actually put (your cost basis) in equals $96,000. That means $398,323.38 came from compounding interest, and that my friends, is why Einstein remarked that it is the 8th wonder of the world. Scenario 1: 40 Years of Saving Cost Basis: $96,000 Total: $494,323.38 Gains: $398,323.38 Now, let’s see what happens if you wait until age 35, giving yourself 30 years to invest. Scenario 2: 30 Years of Saving Cost Basis: $72,000 Total: $233,898.13 Gains: $161,898.13 Your ending balance for retiring is halved, and then some. Even though you just took 25% of the time spent saving, you can see that those first ten years helped form over 50% of your ending balance. And if you wait even longer, maybe until you’re 45, giving yourself 20 years of saving before retirement... Scenario 3: 20 Years of Saving Cost Basis: $48,000 Total: $101,511.14 Gains: $53,511.14 Ouch. Your cost basis in this scenario is $48,000, so we still see what a great impact investing can have over time, but it just doesn’t compare to the first scenario. In fact, if you wait until age 45, you would have to contribute $975 per month for 20 years in order to get the same account value at 65 as if you had started at 25 and contributed $200. Scenario 4: 20 Years of Saving II

Cost basis: $234,000 Total: $494,851.84 Gains: $260,851.84 So what’s the bottom line? The earlier you start, the less you will need to put away. If you are in your 20’s and haven’t started saving for retirement yet, it is worthwhile to evaluate your budget and start allocating something to a retirement account. If you haven't started saving for retirement, and are past your twenties, don’t be too hard on yourself. Starting today is better than never, and putting money in an IRA (Roth or traditional) for yourself will give you more benefits than a regular savings account. *These scenarios are not indicative of real, past or future performance but are based on an investment account with a moderately aggressive allocation earning an average of 7% annually. Calculator used for scenarios: https://www.bankrate.com/calculators/savings/simple-savings-calculator.aspx

0 Comments

Leave a Reply. |

Archives

April 2021

Categories |

RSS Feed

RSS Feed