Wait... there's still time to save on your 2019 tax bill?!

As a former financial advisor, I can’t help but feel like I have a leg-up on the financial side of this entrepreneur game. Now, I’m by no means “rich”, but I do understand the way to get there, and have faith in the financial processes that a lot of people, unfortunately, never understand.

One of the worst things about working for yourself, especially when you are first starting out, is trying to understand the tax and investing side. It seems like these things are almost overly complicated on purpose, designed to leave you stressed and in the dark. Stressed enough to just hand it over to someone else to figure out for a few hundred (or thousand) dollars. Or worse… to ignore it.

Ignoring these stressful problems will only give you even more stressful problems to deal with later down the road, like trying to calculate your taxes from the last five years and realizing you’re broke as a joke because you didn’t set enough of your earnings aside to pay said taxes. You might realize that you need to sell the nice new BMW you bought after winning that last big client, or your last successful course launch. Or, that you need to hustle your butt off the next few months and try and bring enough in to cover your tax bill.

This is the last thing you want. The best way to avoid big tax problems when you’re self-employed is to stay on top of them. You need to put on your big-kid business pants, and put your money in the right places, every time you bring it in. Forming Good Financial Habits

Just like forming other habits, like exercising and drinking enough water, setting up good financial habits when you’re self-employed is crucial. And it certainly doesn’t happen overnight.

It’s good practice to know what categories your income needs to cover, and allocate to them accordingly either every time you are paid, or on a regular schedule, like monthly or quarterly. Consistency is key, because when forgotten about, money problems can easily snowball in a direction you don’t want. Your categories will be somewhat unique to you and your business, but should cover at least the following: taxes, investing, expenses, and salary. I’m sure you’re all too familiar with the expenses you need to cover, and hopefully you’re also familiar with a salary, or paying yourself and any other employees or contractors you have. Most entrepreneurs understand this aspect of their finances, the real problem is... they tend to put off the other two- taxes and investing. Successful entrepreneurs understand that these two items should be top-of-mind, not an afterthought. So let’s dig in! Setting aside money for taxes

Yuck, but fine. How much should you set aside? And where?

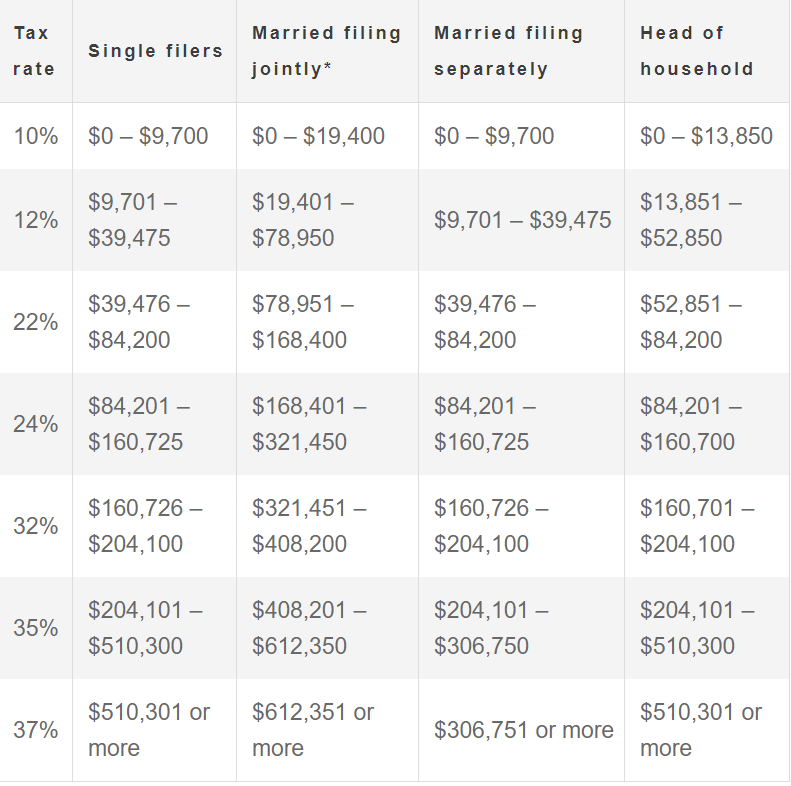

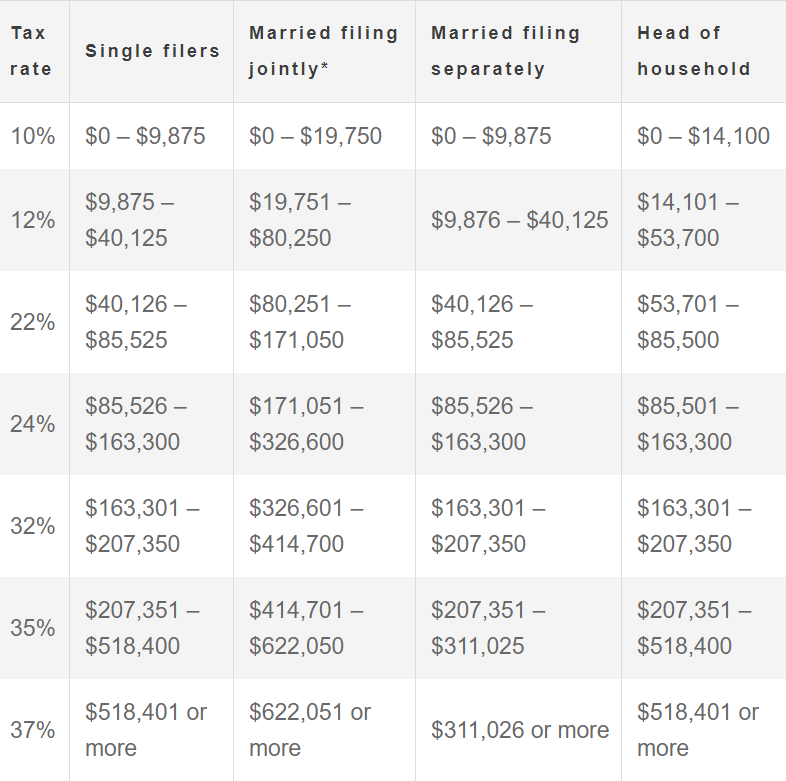

Most agree on setting between 20-30% aside, but this could vary and depends on how much you are making. If you aren’t making a ton (say, less than 100k) consider setting aside 25% of everything you make, and put it in a separate account designated solely for taxes. Have it there and ready to pay taxes every quarter, and at the end of the year. If you’re making more, you should consider setting aside more, depending on what tax bracket you expect to be in. For example, a single filer with income over $520k annually will find themselves in the 37% bracket, meaning setting aside 25% ain't gonna cut it. Adjust accordingly, and check out the tables below to give yourself an idea of what your tax bracket could be this year. Please note- this is just a guideline. Your tax situation is unique and will also be impacted by your state, if you are single or married, if you have dependents, if you have other income… for a more accurate tax estimate, consult a tax professional!

Thanks for the tables, debt.org

The more you earn, the more you should be putting aside. Keep in mind we operate on a tiered tax structure, so if you are a single filer and have an earned income of 600k, not all of your 600k is taxed at 37%, just the portion within that bracket, or everything over $510,301. If you wanted to pay attention and scale up the percentage you set aside as you earn, that’s fine. If that’s adding extra work that you probably won’t do, decide to set aside a fixed percentage, like 30% or 35%, throughout the year.

You could leave this designated tax money in your business checking, but if you are using those funds regularly for your business and think there’s a chance you could spend them if left there, strongly consider moving it to a separate account. If your money is just sitting there, waiting to be handed over for taxes, you might as well earn a little interest on it. You could put it in a high-yield savings account (I’ve personally tried and like Synchrony and Ally) and earn over 1%, which happens to be over 100x better than the 0.01% the big banks will give you. You can read about why that's so important here. As an entrepreneur, you are responsible for withholding and paying your own taxes, it is not automatically done for you like in a W-2 job. Forming the habit of setting aside money specifically for taxes, and paying them quarterly and annually, should significantly reduce some of your financial stress. It certainly won't be a stroll in the park at first, but once you have done it a few times and feel on top of knowing what you owe, when you owe it- and have the money aside for it- it is so much easier! Investing for retirement when you're self-employed

$This is a topic where being self-employed will either absolutely screw you, or make you an easy millionaire.

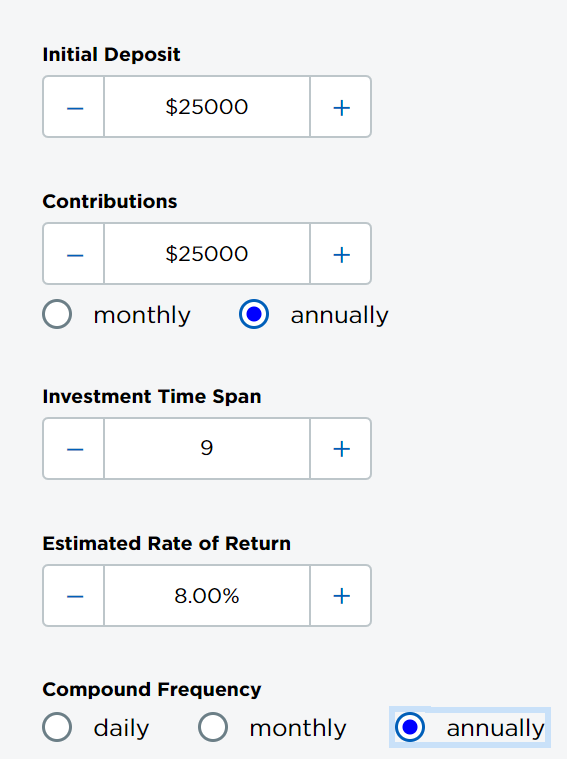

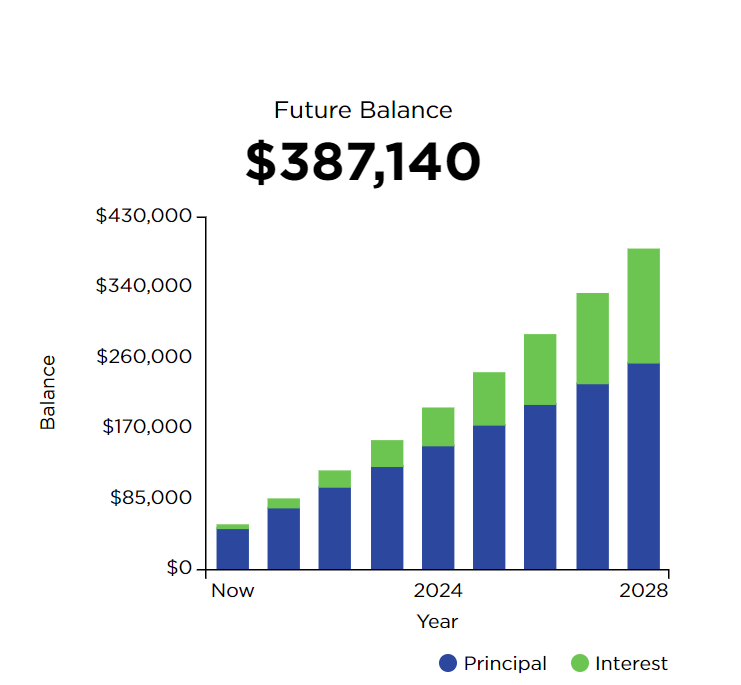

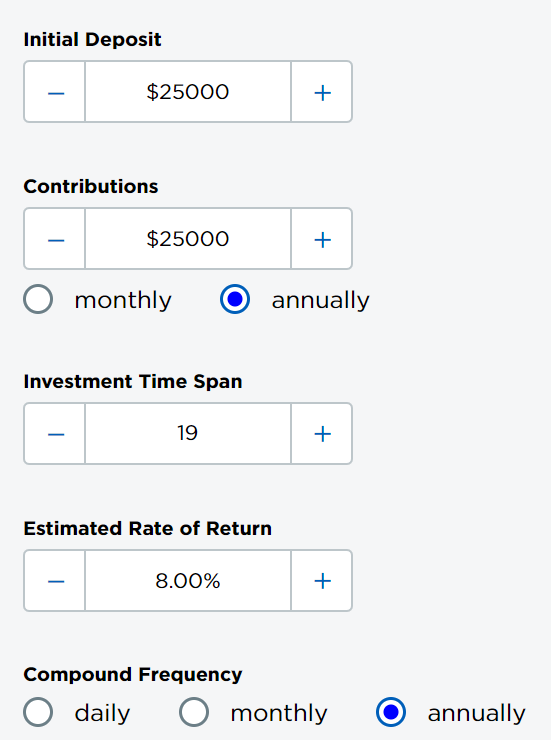

Unfortunately, the majority of Americans are behind on saving for retirement, and the main way to save is within an employer-sponsored plan, like a 401k or 403b. The problem with this is that not everyone is offered a 401k or 403b through work, and many are not up to the task of figuring out how to save for their future on their own. If you’re self-employed, congrats, you are in the category that won’t have access to one of these plans. At least, not unless you set one up for yourself! You certainly aren’t getting automatically enrolled in a 401k and getting an employer match from someone else. You’re responsible for the enrolling, the investing, and the employer matching. The next problem is, people assume this is way more complicated than it is! The presumed complexity, combined with the thought of “oh, but retirement is so far away, I’ll figure it out later…” means that a lot of entrepreneurs are probably behind on saving. As a self-employed individual, my favorite way to save for retirement is with a SEP IRA. SEP stands for Simplified Employee Pension, and IRA stands for Individual Retirement Account. If that feels like a mouthful of alphabet soup, just know that a SEP IRA is your new best friend if you are self-employed and don’t have any employees. (If you do have employees, check out this overview on all the different IRA’s you could potentially use). A SEP IRA, when invested, is like a savings account on steroids that is set aside, not to be touched until retirement. This might seem annoying at first, but once you see how nicely these things grow, especially the longer you don’t touch them, you’ll feel differently. And if you save enough, you might be able to retire earlier than you thought. If you’re a solopreneur, and sad about paying so much in taxes, one of the easiest ways to lower your tax bill is by lowering your taxable income. What, by making less?! No, by saving in a retirement account like a SEP IRA, silly! Remember when we said to set aside 25-30% for taxes? Well, saving in a SEP IRA will directly lower your taxable income, meaning you can set aside that 25-30% after you’ve saved a little for yourself first. For the sake of round numbers, let’s say you bring in $100,000 of earned income for the year. If you’re in the habit of saving for your taxes, and were putting 30% aside, you’d put $30,000 away for taxes. $30,000 for taxes? Ouch. Now, the advantage of a SEP IRA... SEP IRA’s have an annual limit of 25% of your earned income (up to a max of $56,000 for 2019 and $57,000 for 2020). So, you could potentially put $25,000 (25% of your $100k) in your SEP, leaving you with $75,000 of taxable income. You would then save 30% (or even 25% now that you are staying out of the higher brackets) of your $75,000 to go towards taxes, or $22,500. Not only is that a $7,500 difference in taxes, but you still have a large chunk of your hard-earned money! The trick is to now repeat- and leave it alone. We used a 100k as an example, which may seem like a lot, or a little, depending on your situation. But the point is, you can save 25% of your earned income in a SEP IRA, up to the annual limit. Everything you contribute to your SEP IRA is then deducted from your taxable income, meaning you have a smaller amount to pay taxes on. (Please note, there are many more factors that go into calculating your taxes! These are rounded estimates, and do not represent an actual tax calculation. Always speak to a tax professional if you have questions about your taxes). When you save in a SEP IRA, you are lowering your taxable income for that year, and every year you contribute money. If you put $1,000 in your SEP IRA in 2020, you can deduct that $1000 from your income when you do your taxes at the end of the year. If you put in $25,000, you deduct $25,000. SEP IRA’s can provide some serious tax savings for now, but... when does this money get taxed? When you take it out in retirement. But the idea is that it will be growing steadily until then, and your earnings will be significant enough to cover your future taxes. Many also hope to be in a smaller tax bracket in the future, when they are retired and no longer earning income, which means hopefully less in taxes. And if you need more convincing, let's pretend you save 25k a year in a SEP IRA, for the next 10 years. If your money is invested in the US stock market, you can expect to earn an average of 7-10% annually. I like to use 8% for future estimates. In this scenario, you have saved a total of $250,000 over 10 years. Definitely something to be proud of! But your ending balance... $387,140! That's an extra $137,140 that you earned in interest!

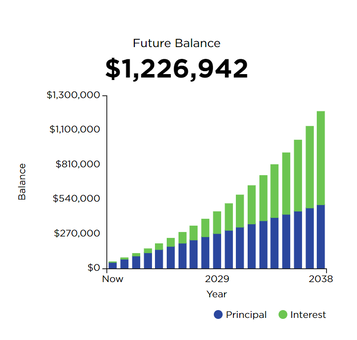

And the longer you keep it up, the better. 20 years of saving at this rate will give you...

Over ONE MILLY! You could be looking at $1,226,942, only $500,000 being your own contributions!

Making money is a wonderful feeling. Keeping it, is even better. And even better than that? Growing it. Paying yourself first, and saving for your future, is the best way to accumulate wealth. Plus it’s nice to look back on your working years, especially ones where you were doing well, and still having something to show for it. “Wow, I remember when my business had it's first $100,000 year in 2020! That was awesome. And, that’s when I started my SEP IRA, and I put in $25,000… which grew to SO MUCH MORE!" How to still save on taxes for 2019

Now that you understand more of the processes in place behind taxes and investing, we can better answer the original question: “HOW DO I SAVE NOW?!”

Because we are in the middle of a global pandemic, the world is (rightfully) freaking out a little. Our 2019 tax deadlines have been moved to July 15th, 2020 extended from the regular filing date of April 15th. You have until tax day to contribute to your IRA’s, which means you have until July 15th, 2020 to contribute to a SEP IRA for 2019 and lower your tax bill! If you already filed your taxes, it might not be worth going back and filing an amended return, but it is definitely still possible. If you are able to put a good sized chunk of money in for 2019, getting with a tax professional and filing an amended return could be well worth it. If you haven’t yet filed, this is a perfect opportunity to capture some savings for 2019 and lower your taxes! I hope getting some insight on this valuable tool has given you encouragement to get started! But, if you’re like most and feel overwhelmed by all this, sign up below to hear about my upcoming, FREE webinar, where I will go more in depth on how entrepreneurs can save for their futures and simultaneously lower their tax liability!

2 Comments

Rachel

5/23/2020 11:31:52 pm

Curious to know if you can contribute to a SEP IRA if you are self employed and also have a W-2 income with no 401K? Thanks!

Reply

Alicia Friend of Finance

5/29/2020 10:01:13 am

Rachel, short answer- yes! Just make sure your SEP contributions are not more than 25% of your self-employed income! If you wanted to contribute more, I would look into also opening a Traditional IRA or Roth IRA.

Reply

Leave a Reply. |

Archives

April 2021

Categories |

RSS Feed

RSS Feed