The crucial financial decisions I wish I could have told my younger self

Ah, the gift of hindsight. Unfortunately, I was not as money-savvy at 18 as I am now, ten years later. Since my time machine is out for repairs, I hope these three tips can help you, regardless of your age!

1. You should be earning interest on your savings

By the time I was 18, I was pretty used to the old savings rodeo, or so I thought. I had been working a “real job” for two years, had already bought my first car on my own, and was saving up for college classes at the local community college. But where was I keeping my precious savings? In a plain, old, not-earning-any-interest savings account!

I didn’t learn about high-yield savings accounts until my 20’s, and now I try to avoid keeping more than $1,000 in a savings account that isn’t earning over 1%. A high-yield savings account gives you a higher interest rate on the money you have saved, and one or two percent can make a big difference over time! If I could show my 18-year-old self a compounding interest calculator and the difference of earning 0.01% versus 2.00%... I would have made the switch to high-yield savings a lot sooner! 2. Investing is NOT as complicated as you think!

Sometimes my friend and I would carpool to school in the morning with her dad going to work. I remember many mornings of him in the front seat, checking stock prices, and grumbling about what was up and what was down. At the time, I thought it was a little silly, and honestly never thought that kind of stuff would be of any concern to me. Oh, was I wrong.

It was so easy to tune out that investing nonsense, little did I know that I would have an entire blog dedicated to the topic a few years later! Investing is something that seems very foreign at first, but once you sit down and look at the historical returns of big companies that have been around awhile, and at how compounding interest can work in your favor, investing becomes a no-brainer. I would also have told myself that you don’t have to invest in a single company at a time, that you can invest in an entire index, all in one share. This means you can hold a piece of many companies, instead of trying to pick the winners! 3. You should start saving for retirement ASAP

Retirement couldn’t be further away in the mind of an 18-year old. There are so many other financial concerns, like being out on your own for the first time, paying for school, paying for food, paying for activities, paying for clothes… all the unnecessary clothes. It’s understandable that “saving for retirement” isn’t front and center on the financial to-do list.

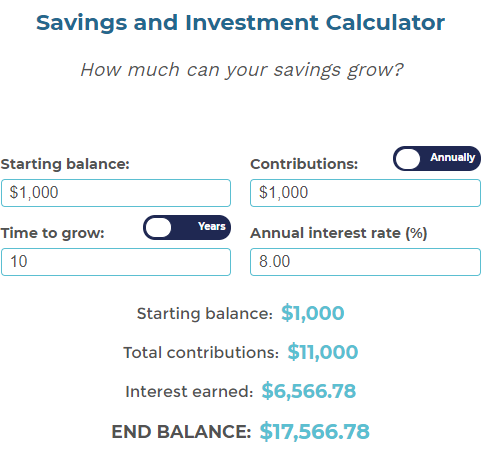

But again, if someone had sat me down with a compounding calculator and showed me what saving and investing just $1000 a year could do for my future…

I’m sure I would have made the effort. In this example, $1000 is saved every year for 10 years and earns 8% in interest. At the end of 10 years, you end up with $17,566, with over $6500 coming from compounding interest! The more you can save, and the EARLIER you can save it, the more compounding interest you see!

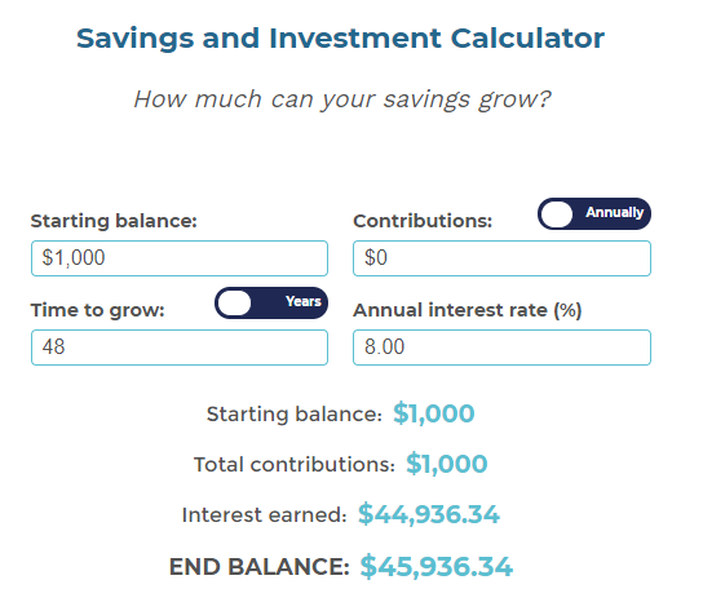

To give another perspective, let’s say an 18-year old invests $1000, and then forgets about it until age 60. Growing at 8%, 48 years later, that $1000 is now worth…

ALMOST $46,000!!! If you knew that every thousand dollars you saved at 18 could grow to $45,936, how many thousands would you try to save? The sooner you understand how much compounding interest can benefit you if time is on your side, the happier you will be in retirement!

While I am thankful to have gotten these lessons in my 20’s while I still have a good chunk of time on my side, I realize the sooner these lessons are learned, the better. Compounding interest is no joke- if you want to explore more, check out Friend of Finance's Calculator with your own numbers! How much can you save for retirement?

While you might be eager to start saving and investing for the future now that you’ve seen what compounding interest can do, there are a few rules to know still. There are different types of investment accounts, with retirement accounts making up a large portion of them. Because retirement accounts have great tax perks, like deducting your annual contributions from your income at tax time, or growing tax-deferred until retirement, there are limits to how much you can save.

Different accounts have different limits, and these are typically updated every few years to keep up with inflation. To learn more about 2020’s contribution limits, check out this post or grab a free download of the Entrepreneur Financial Cheat Sheet! While this information is a MUST for people who are self-employed, it’s applicable to anyone who wants to save for their future! Grab your free copy below!

Can you relate to these three financial tips? What would you have told your younger self if you had the opportunity? Let me know in the comments below!

If you know any young people that can benefit from these money tips, help change their financial future by sharing this post with them!

1 Comment

12/18/2022 05:40:16 am

This inspires me. This idea changed as we grew older and realized how frivolous with the money we had been in the past. And we have come to counsel ourselves on it.

Reply

Leave a Reply. |

Archives

April 2021

Categories |

RSS Feed

RSS Feed